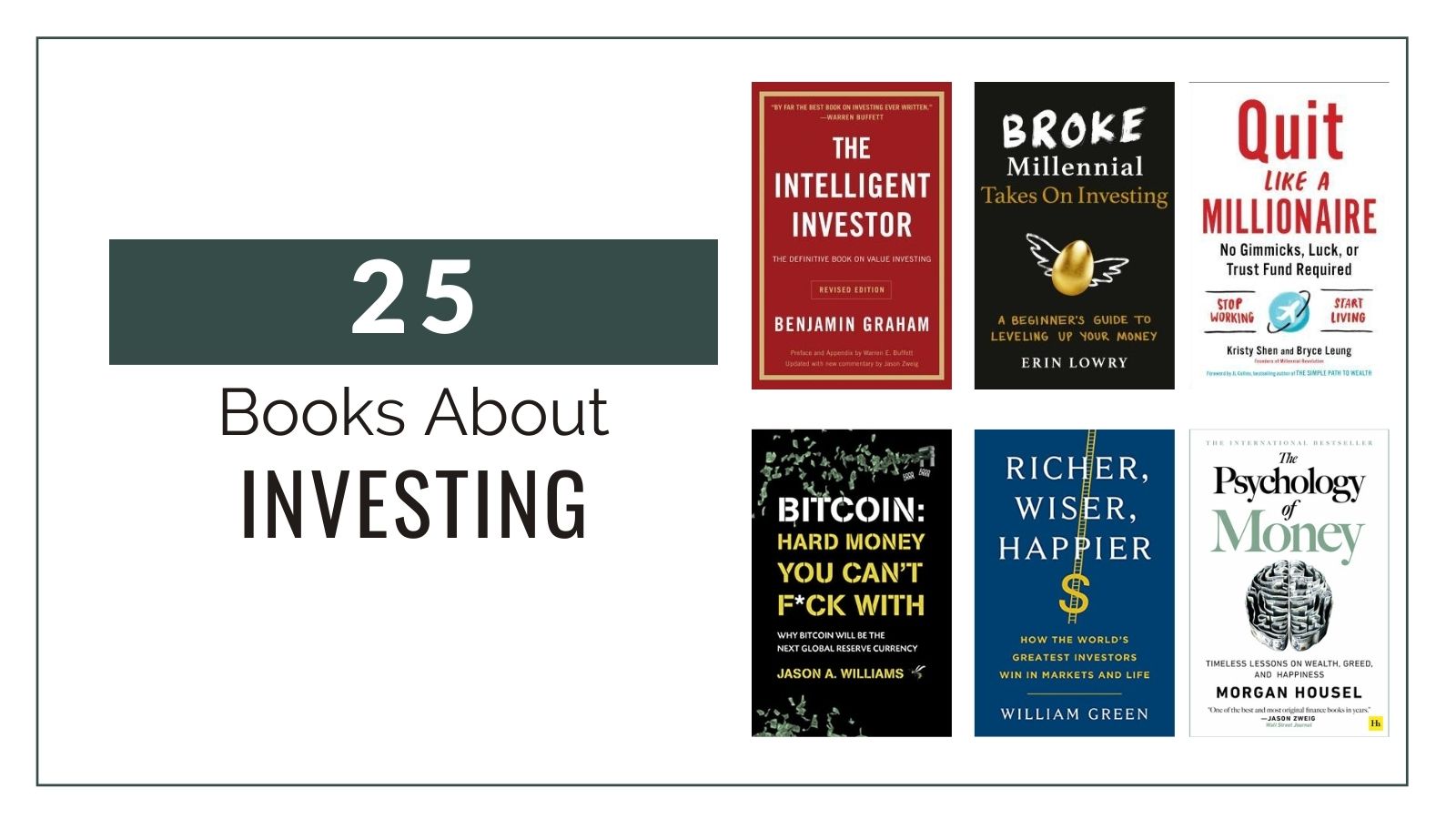

25 Best Investing Books

- Home

- Investing

If you're looking for a crash course in investing, or are simply looking to add more knowledge to your investing toolkit, then these 25 best investing books are for you.

Each book offers its own unique perspective on the world of investing, and will help teach you about everything from stocks and bonds to asset allocation and risk management.

Whether you're a beginner investor just starting out, or an experienced investor in search of some new tips and tricks, be sure to give these books a read.

1. The Intelligent Investor

Written by: Benjamin Graham

Published: 2006 (Original publish date: 1949)

Pages: 623

The Intelligent Investor is a book by Benjamin Graham that is considered one of the most influential books on investing. The book was first published in 1949 and has been revised several times since then.

The book is divided into four parts: "Context," "The Investor and Market Fluctuations," "Stock Selection for the Defensive Investor," and "Stock Selection for the Enterprising Investor." In the book, Graham guides how to approach investing in a rational and disciplined manner.

He also discusses the importance of both fundamental analysis and technical analysis.

Even though it was written over seven decades ago, it is essential reading for any investor who wants to learn more about sound investment principles.

2. If You Can

Written by: William J. Bernstein

Published: 2014

Pages: 48

This book is an excellent short read for anyone looking to get a handle on the basics of investing. And by short read, we mean about 60 or so pages!

The book covers many topics, including the history of investing, the different types of investment vehicles, and the risk/reward tradeoff. Bernstein also explains the role of luck in investing and how even the best investors can sometimes get lucky (or unlucky).

We love that he also suggests other information to read so you can get more data. It is a well-written and informative book worth reading for anyone who wants to learn more about investing.

3. Broke Millennial Takes on Investing: A Beginner's Guide to Leveling Up Your Money

Written by: Erin Lowry

Published: 2019

Pages: 256

In this book, Lowry provides an overview of the basics of investing for millennials looking to get started in the world of investing.

Lowry begins by exploring the different options available for savings and investment, including 401(k)s, IRAs, and brokerage accounts. She then provides an overview of the different types of investments, such as stocks, bonds, and mutual funds.

Lowry also discusses the importance of diversification in investing and offers tips on creating a diversified portfolio.

Finally, she tackles the topic of risk management and provides advice on how to minimize risk while still achieving one's financial goals. She is a millennial; she knows what she is writing about here.

4. The Simple Path to Wealth

Written by: JL Collins with a foreword by Mr. Money Mustache

Published: 265

Pages: 2021

Collins’s approach is based on the principles of saving and investing, and he provides readers with easy-to-follow instructions on how to get started.

He also offers valuable advice on how to stay the course during difficult times when it can be tempting to give up.

The main ideas focus on things to avoid, saving and living a thrifty lifestyle, stock market and investing advice, and "F-You Money," which means money that you can be aggressive with and take chances.

This isn't a get-rich-quick scheme, so it is crucial to anyone who wants to invest and feel secure in their choices.

5. Bitcoin: Hard Money You Can't F*ck With: Why Bitcoin Will be the Next Global Reserve Currency

Written by: Jason A. Williams

Published: 2020

Pages: 218

Williams makes a case for why he believes that bitcoin will be the next global reserve currency. He begins by explaining what money is and how it derives its value. He points out that money has three main functions: to act as a store of value, to be a medium of exchange, and to be a unit of account.

He argues that bitcoin satisfies all these criteria better than any other currency currently in existence. For example, he points out that bitcoin is scarce, durable, divisible, and portable.

He also argues that the decentralized nature of the Bitcoin network makes it much more resistant to manipulation by governments and financial institutions.

Overall, Williams makes a solid argument that Bitcoin will soon take over the world's monetary system.

We love that this book was informative on something that seems so complicated while also being fun and easy to understand.

6. The Behavioral Investor

Written by: Daniel Crosby

Published: 2018

Pages: 282

This book explores the implications of behavioral finance on investment decisions. It discusses how traditional finance models assume that investors are rational and make decisions based on data and analysis.

However, behavioral finance studies have shown that this is not always the case. Investors often make emotional decisions that are not in their best interests. As a result, behavioral finance provides a framework for understanding how these emotions can impact investment decision-making.

Crosby then applies this framework to a variety of real-world scenarios. For example, the author discusses how investor behavior can impact stock prices, corporate financial reporting, and even government policy.

The book is an essential read for anyone interested in behavioral finance and its implications for the way they invest and stay calm when things are getting wild.

7. Quit Like a Millionaire: No Gimmicks, Luck, or Trust Fund Required

Written by: Kristy Shen and Bryce Leung

Published: 2019

Pages: 336

We love that the authors use their own lives as examples to show that anyone can achieve financial independence if they are willing to make some sacrifices and follow a few simple principles.

One of the most important principles is to live below your means. You often hear people say this, but this book gives you concrete ways to achieve this goal.

The authors advocate making lifestyle changes that will allow you to save as much money as possible to quit your day job and live off your investments eventually.

They also emphasize the importance of investing in index funds and other low-risk vehicles to grow your wealth over time. They make it sound easy because it can be if you stick to your plan.

8. The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns

Written by: John C. Bogle

Published: 2007

Pages: 216

In this book, Bogle presents the case that the best way to achieve stock market returns is to invest in a low-cost index fund. This may sound easy, but this gives a deep dive into the subject.

He argues that actively managed funds are inherently wasteful and that investors would be better off if they simply put their money into an index fund and held it for the long term. Bogle provides a clear and concise case for why he believes index investing is the best strategy for individual investors.

While other books make similar arguments, Bogle's writing is clear and easy to understand, making it an excellent choice for those who are new to investing.

9. A RANDOM WALK DOWN WALL STREET: THE TIME-TESTED STRATEGY FOR SUCCESSFUL INVESTING

Written by: BURTON G. MALKIEL

Published: 2019 (Original publish date: 1973)

Pages: 432

This book was initially known for being very concise and a primer on setting up your portfolio; it has been updated to help deal with today's financial situations.

Therefore, it is a comprehensive guide to subjects such as bitcoin, automated investment advisers, and fascinating topics such as "tax-loss harvesting."

Beyond that, he also goes into subjects such as how to invest in real estate, gold, and other collectibles, and owning your home as ways to invest.

The beauty of this book is that you genuinely get a random walk down Wall Street, as there is so much more to it than just stocks and bonds, even though they are covered here as well.

So, don't stress, and go for a nice walk as you learn about how you can become wealthy.

10. Think & Trade Like a Champion: The Secrets, Rules & Blunt Truths of a Stock Market Wizard

Written by: Mark Minervini

Published: 2017

Pages: 235

This book is a comprehensive guide to becoming a successful stock market trader. He provides readers with a step-by-step plan for developing the mindset and skill set needed to achieve success in the market.

He also covers essential topics such as risk management and position sizing.

In addition, Minervini shares his trading strategies and tactics, which have been proven to produce consistent profits. This includes his record-breaking trade of United Online, which made him $30 million in just six months.

11. The Warren Buffett Way

Written by: Robert G. Hagstrom

Published: 2004

Pages: 262

First published in 1996, The Warren Buffett Way is a best-selling book that outlines the investing strategies of one of the most successful business people of our time.

Written by Robert G. Hagstrom, a former equity research analyst, the book draws on interviews with Buffett himself and his annual letters to shareholders to provide insight into his investment philosophy.

Some key themes include Buffett's focus on companies with substantial competitive advantages, his preference for simple over complex businesses, and his belief that buying shares are like buying a piece of a business.

While some of Buffett's ideas may seem counterintuitive at first, Hagstrom does an excellent job of explaining how they have helped make him one of the richest men in the world. For anyone interested in how one of the wealthiest people in the world became just that, this is a must-read.

12. How to Day Trade for a Living: A Beginner's Guide to Trading Tools and Tactics, Money Management, Discipline, and Trading Psychology

Written by: Andrew Aziz

Published: 2020

Pages: 366

Many people dream of quitting their day job and becoming professional day traders. And why wouldn't they? Day trading offers the opportunity to earn a substantial income without committing to a traditional 9-to-5 job.

But before you can start cashing in on lucrative trading opportunities, you need to understand the basics of the trade.

This beginner's guide will teach you everything you need to know about day trading, from the tools and tactics you need to get started to the money management and discipline required to succeed.

You'll also learn about the different types of markets you can trade in and traders' strategies.

So, whether you're looking to quit your job and become a full-time day trader or even just make some money on the side, you’ll want to read this book.

13. The Psychology of Money

Written by: Morgan Housel

Published: 2021

Pages: 242

Most of us have a complicated relationship with money. We can be both attracted to it and repelled by it, desiring it and fearing it. Money is often seen as a source of stress, but it can also be a source of great satisfaction.

Understanding our psychology around money can help us manage our finances better and make better decisions about spending and saving. One of the most important things to understand about money is that our childhood experiences often shape our attitudes toward it.

If we grew up in a household where money was tight, we might associate money with anxiety and insecurity. On the other hand, if we grew up in a family where money was plentiful, we may associate it with happiness and opportunity.

This book does a beautiful job of examining our biases, which we may not even be aware of, using 19 stories.

14. Women & Money

Written by: Suze Orman

Published: 2018

Pages: 206

Women have long been underserved when it comes to financial advice and products. For too long, the financial industry has been geared towards men, focusing on investing and retirement planning.

However, women have unique financial needs that must be considered. For example, women are more likely to take time out of the workforce to care for family members, impacting their ability to save for retirement.

In addition, women tend to live longer than men, meaning they need to plan for a longer retirement. As a result, women need to receive tailored financial advice that meets their specific needs.

That is why Women & Money is so important since it will give women the exact information they need to succeed and not rely on someone else.

15. Clever Girl Finance: Learn How Investing Works, Grow Your Money

Written by: Bola Sokunbi

Published: 2020

Pages: 208

As shown by Suze Orman above, investment is a critical element of financial planning, but it can be confusing and intimidating for many people. That is why this book is so important as it helps women understand investing their money as Sokunbi has dealt with these issues herself.

Bola Sokunbi is a certified financial education instructor and personal finance expert. She offers clear and concise explanations of investment concepts and tips and advice for building a successful portfolio.

In addition to helping readers learn about investing, Clever Girl Finance also provides resources for reducing debt, saving money, and achieving financial independence.

Whether you're just starting to explore the world of investing or looking for ways to take your finances to the next level, Clever Girl Finance is an excellent resource.

16. Trading Options for Dummies

Written by: Joe Duarte

Published: 2015

Pages: 386

Options trading can be a complex and risky investment strategy, but it can also be a powerful tool for generating income or protecting the value of your portfolio. If you're new to options trading, This book is an excellent place to start.

It covers the basics of options trading in clear, easy-to-understand language. Duarte begins by explaining what options are and how they work. He then discusses the different types of options contracts and how they can be used to achieve your financial goals.

Finally, he provides a step-by-step guide to opening and closing options positions.

Whether you're a novice investor or a seasoned pro, this book will help increase your gains and feel more secure in what can be a rollercoaster ride.

17. The Wisdom of Finance: Discovering Humanity in the World of Risk and Return

Written by: Mihir Desai

Published: 2017

Pages: 223

After all the seriousness in many other books on this list, this one offers a refreshing perspective on an often-maligned industry.

Drawing on his experience as both a professor of finance and a successful investor, Desai argues that finance is not a cold, heartless discipline but rather one that is grounded in human values.

Through stories and case studies, including one using a Mel Brooks movie, he shows how finance can be used to promote the common good rather than simply pursuing personal gain.

He challenges the reader to rethink their assumptions about finance and its role in society. The Wisdom of Finance is an enlightening and thought-provoking read for anyone interested in finance or business and not just making money.

18. One Up on Wall Street: How to Use What You Already Know To Make Money In The Market

Written by: Peter Lynch

Published: 2001 (Original publish date: 1988)

Pages: 128

This book is revered as one of the most important books of all time regarding investing in stocks, bonds, and more. Lynch reveals how the average investor can beat the professionals by taking advantage of what they already know.

He shows how to research stocks and identify those with potential for significant growth. He also outlines a simple investing strategy that can be used to profit from these stocks.

While it is geared toward the average investor, it is also a valuable resource for professionals looking to improve their performance.

In addition to providing insights on how to pick winning stocks, the book offers a detailed analysis of the inner workings of the stock market. Even though this book may seem outdated because of when it was published, it is still entirely relevant to today's world.

19. The Money Manual: A Practical Money Guide to Help You Succeed on Your Financial Journey

Written by: Tonya B Rapley

Published: 2018

Pages: 148

This book primarily focuses on people who are new to investing and managing their money. That being stated, it is a comprehensive guide that covers a wide range of financial topics, from saving and investing to managing debt and credit.

The book is divided into five sections: The Foundations of Money Management, Saving and Investing, Managing Debt and Credit, Making Major Purchases, and Financial Planning for the Future.

Each section includes various helpful tips and strategies that readers can use to improve their financial situation. The book also includes an appendix with resources for further reading.

Overall, The Money Manual is an excellent resource for beginners who wants to learn more about personal finance.

20. The Essays of Warren Buffett: Lessons for Corporate America

Written by: Lawrence A. Cunningham and Warren E. Buffett

Published: 2019

Pages: 350

This book is a compilation of articles and letters written by business magnate Warren Buffett. The book was edited by Lawrence Cunningham, a professor of law at George Washington University.

First published in 2001, the book contains essays that provide insights into Buffett's investing philosophy and business strategies. Covering topics such as value investing, risk management, and corporate governance, The Essays of Warren Buffett is considered essential reading for anyone interested in learning from one of the most successful investors of all time.

In addition to offering valuable lessons on investing, the book also provides a glimpse into Buffett's unique approach to business and life. As he once said, " If you don't find a way to make money while you sleep, you will work until you die.”

21. Richer, Wiser, Happier: How the World's Greatest Investors Win in Markets and Life

Written by: William P. Green

Published: 2021

Pages: 304

In this book, Green shares the stories of some of the most successful investors of our time. These include Warren Buffet, Sir John Templeton, Laura Geritz, and others. Green argues that these investors have not only made a fortune in the financial markets but have also found lasting happiness and satisfaction in their lives.

Through in-depth interviews and case studies, Green reveals the secrets to their success. He shows how they have developed a deep understanding of both human behavior and the market forces that drive it.

Armed with this knowledge, they have made wise decisions that led to financial success and personal fulfillment. Green's book is an inspiring look at what it takes to be a truly great investor and a guide for you to be successful at the same time.

22. Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent Money

Written by: Nathaniel Popper

Published: 2015

Pages: 416

This book is a fascinating read about the history and development of Bitcoin. The book chronicles the rise of Bitcoin and the individuals who have been instrumental in its development.

Popper does an excellent job of explaining the intricate technical details of Bitcoin in a way that is accessible to a non-technical reader.

He also provides insights into the motivations of the various players involved in the Bitcoin world, from the early adopters who saw its potential to subvert the existing financial system to more recent investors who are betting on its future as a mainstream currency.

Overall, Digital Gold is a well-written and informative book that provides valuable insights into the newly evolving world of Bitcoin and cryptocurrency.

23. Unshakeable: Your Financial Freedom Playbook

Written by: Tony Robbins

Published: 2017

Pages: 256

If you're looking for a comprehensive guide to financial freedom, look no further than Tony Robbins' Unshakeable. In this book, Robbins lays out a step-by-step plan for achieving financial security, offering readers practical advice on everything from investment strategies to building a positive relationship with money.

With straightforward language and an engaging style, Robbins makes complex concepts accessible to everyone, whether you're just beginning your journey to financial freedom or already on your way.

In addition to providing valuable information and insights, Unshakeable also includes actionable exercises that will help you put what you've learned into practice.

Whether you're looking to get out of debt, save for retirement, or simply build your financial knowledge, this book needs to be on your bookshelf.

24. Smart Money Smart Kids: Raising the Next Generation to Win with Money

Written by: Dave Ramsey

Published: 2014

Pages: 272

Dave Ramsey is a well-known financial expert who has helped countless people get out of debt and build wealth. In his book Smart Money Smart Kids, Ramsey offers advice for parents who want to teach their children how to manage money wisely.

Ramsey begins by emphasizing the importance of setting a good example. If parents constantly argue about money or make impulsive purchases, their children will likely do the same.

Instead, parents should strive to be good stewards of their finances, and their children will follow suit. Ramsey also stresses the importance of giving children an allowance, which can help them learn how to budget and save properly.

Furthermore, he advocates teaching kids about the different types of financial institutions, such as banks and credit unions.

25. Rich Dad, Poor Dad

Written by: Robert T. Kiyosaki

Published: 2019 (Original publish date: 1997)

Pages: 104

The author shares his story of growing up with two very different fathers in this book. One father was his biological father, a highly educated man who worked hard but never seemed to get ahead financially.

The other father was his friend's dad, a self-made millionaire who had little formal education but could always provide for his family. Through his experience with these two men, Kiyosaki learned some valuable lessons about money and success.

He discovered that financial success is not about how much money you make but about how you manage the money you have.

He also learned that it is possible to make a good living without having a traditional job. These lessons have helped him become who he is today.

NOTE: The "Rich dad" was made up by Kiyosaki as a character to prove his point. Therefore, this is technically somewhat fiction. However, because it still gives many valuable tips and ideas on becoming wealthy, we decided to add it to our list.